Unlocking Wellness: How to Make the Most of Flexible Booking Platforms

In today’s fast-paced world, finding time for wellness and relaxation can be challenging. But what if there was a way to access a wide range of fitness, spa, and recreational services at your convenience – all through a flexible, coin-based booking system? Enter the era of innovative wellness platforms, designed to make self-care easier and more accessible than ever.

In this guide, we’ll explore how flexible booking platforms like DayPass are revolutionizing the way we approach wellness. From selecting the right membership to maximizing your coin balance, here’s how to make the most of these modern solutions.

1. Why Flexible Booking is the Future of Wellness

Gone are the days of long-term contracts and rigid schedules. Today’s wellness platforms cater to your dynamic lifestyle, allowing you to choose services that align with your personal needs and preferences. Whether you’re craving a yoga session, a high-intensity workout, or a rejuvenating spa day, flexible booking systems empower you to plan self-care on your terms.

With just a few clicks, you can access a diverse range of services from top-notch providers, ensuring variety and excitement in your wellness journey.

2. How Coin-Based Systems Work

At the heart of these platforms is an innovative coin-based system. Here’s how it works:

- Choose Your Membership Plan: Start by selecting a membership that suits your lifestyle. Whether you’re an occasional visitor or a regular wellness enthusiast, there’s a plan tailored to your needs.

- Get Your Coins: Upon subscribing, you receive a set number of coins. These coins act as your digital currency, allowing you to book and pay for services effortlessly.

- Book with Ease: Simply browse through the available services, check the coin value required for each, and confirm your booking. It’s that simple!

This approach not only streamlines the booking process but also gives you the freedom to try different services without any long-term commitment.

3. Maximizing Your Coins: Tips and Tricks

To get the best value out of your coins, consider the following strategies:

- Compare Services and Prices: Most platforms allow you to compare the coin values for various services. This feature helps you make informed choices based on your budget and preferences.

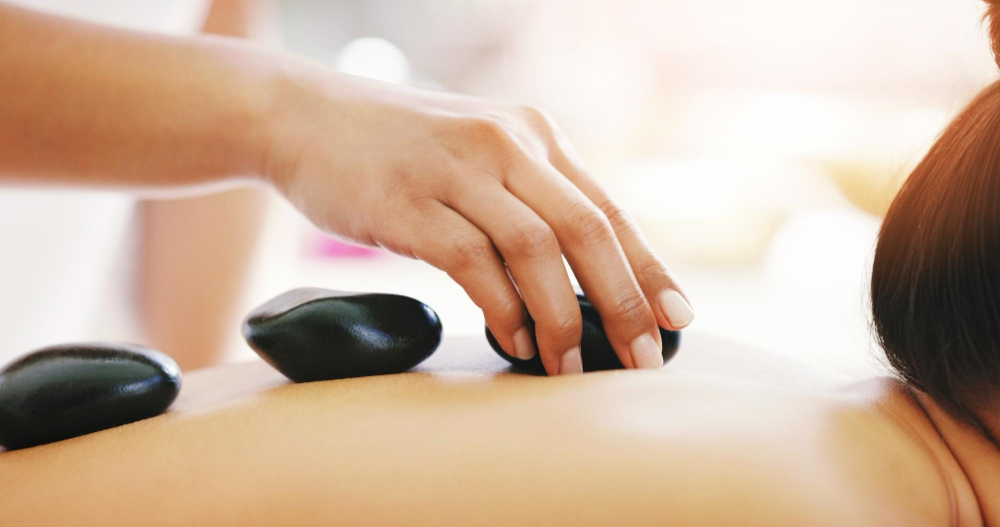

- Mix and Match Experiences: Use your coins to explore a variety of activities – from yoga classes and gym sessions to spa treatments and recreational events. Diversifying your experiences keeps your wellness journey exciting and balanced.

- Plan and Save: Keep an eye on special promotions or discounted services. Booking during off-peak hours can also help you save coins for future use.

4. The Benefits of Flexible Wellness Platforms

- Convenience and Accessibility: Book services anytime, anywhere, through user-friendly mobile apps or websites.

- Variety and Choice: Discover new experiences by accessing a wide range of wellness options under one platform.

- Cost-Effective: Pay only for what you use, eliminating the need for long-term contracts or memberships at individual centers.

- Personalized Experience: Tailor your wellness routine to fit your schedule and preferences, making self-care more enjoyable and stress-free.

5. Getting Started: What to Look for in a Wellness Platform

Before choosing a wellness platform, consider the following:

- Service Range: Ensure the platform offers a variety of services that cater to your interests and needs.

- User Experience: Opt for a platform that provides a seamless browsing and booking experience.

- Customer Support: Check for responsive customer support to assist you with bookings and queries.

- Transparent Pricing: Look for transparent coin pricing and clear terms to avoid any hidden costs.

6. Embrace Flexibility and Discover Wellness Your Way

Flexible booking platforms are changing the way we approach wellness by offering a customized and user-friendly experience. With the freedom to choose, compare, and book services at your convenience, you’re no longer tied down by rigid schedules or contracts.

Whether you’re a busy professional looking for a quick stress-relief session or a fitness enthusiast eager to explore new workouts, these platforms provide the flexibility to make wellness an integral part of your lifestyle.

Conclusion: Redefine Your Wellness Journey

Wellness is personal, and so should be your approach to it. By leveraging the power of flexible booking platforms, you gain control over your wellness routine – making it easier to stay consistent and motivated.

Ready to unlock a world of wellness? Start exploring flexible booking options today and experience the ultimate freedom in self-care.

Stay flexible. Stay well.

Whether you’re a beginner or a wellness pro, there’s always something new to discover. Choose your membership, get your coins, and redefine your wellness journey – one experience at a time.